Approve the new campaign to increase the Pension Plan’s variable contribution, with the objective of considerably increasing the plan’s contribution volume and, consequently, improving the level of participants’ future retirement benefits, as well as the collection of the SERPROS administrative contribution .

Scope

- Wireframes

- Flowcharts

- UX Research

- User Interface

- Prototyping

My role

- Product Design

Team

- Marcelo Lima – Product Design

- Luiz Nuss – Product Manager

- Flavio Fernandes – IT Manager

- Tatiana Tavares – Actuarial Manager

- Tadeu França – Actuarial Analyst

Challenge

The Challenge is to increase the contribution percentage to the maximum limit allowed in the Pension Plan.

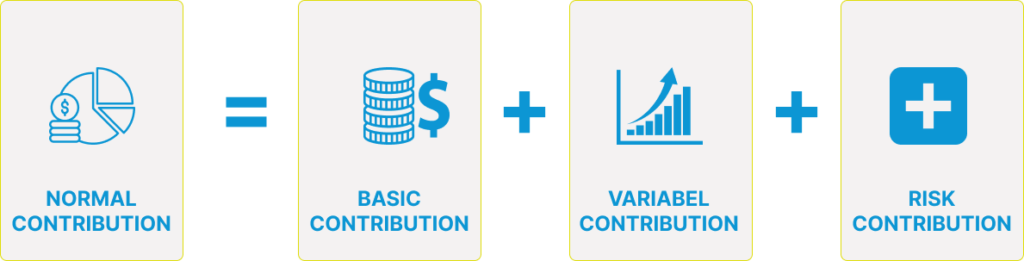

The Normal Contribution provided for in the Pension Plan’s regulations is made up of the sum of the Basic Contribution, Variable Contribution and Risk Contribution.

The Basic contribution is fixed and is determined by applying the percentage established in the Costing Plan to the Contribution Salary, which is currently 1%.

Basic Contribution = Contribution Salary *1%

The Variable Contribution is optional and is determined by applying the percentage chosen by the participant, on the portion of the Contribution Salary exceeding 8 (eight) VRS. This percentage is limited to 15% (fifteen percent).

*Serpro II Reference Value(VRS) = R$ 505.08

Variable Contribution = (Contribution Salary – 8VRs) * Variable Percentage

The Risk Contribution is intended to cover the cost of Sickness Benefit, Incarceration Benefit, Death Savings and Asset Pensions and the Minimum Value Guarantee.

Its value is tabulated and varies depending on the Risk Salary and the age of the participant.

Risk contribution rate = (Risk Salary * Rate levied on the contribution salary) + (Risk Salary – 14 VRS) * Rate levied on the excess of the Contribution Salary in relation to 14VRS

It is important to note that only the Variable Contribution is a participant’s choice, that is, they can opt for any percentage between 0% and 15%, however, the sponsor’s contribution, as it is parity, follows the same variable contribution percentage chosen by the participant.

Research

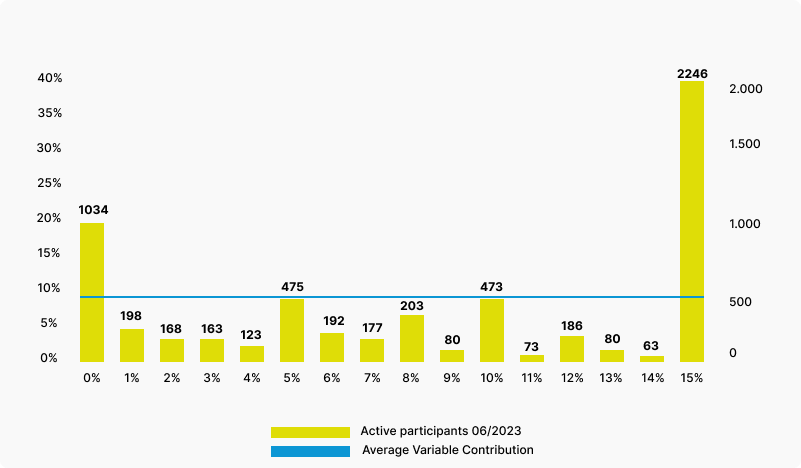

In May/2023, the PSII plan had 5.985 active participants contributing monthly to the plan, 39 of which were self-sponsored.

Of the total number of contributors, 5.934 participants, as they earn above 8VRS, can make a Variable Contribution. However, 3.750 (63%) chose to make a Variable Contribution below the maximum limit of 15% and, of these, 1.002 (17%) participants opted for a 0% Variable Contribution.

Below is the distribution of the number of PSII participants grouped by the percentage of variable contribution chosen.

chose to make a Variable Contribution below the maximum limit of 15%

1,002 (17%) participants opted for a 0% Variable Contribution.

One of the reasons that explains this behavior is the mistaken comparison with retirees from the DB plan, who, due to the characteristics of their plan, did not need to make decisions about the contribution level.

Due to the characteristics of a Variable Contribution (CV) plan, its participants need to be protagonists in the resource accumulation process, that is, they need to decide the percentage of Variable Contribution they will make and, consequently, decisively influencing the value of the benefits they will receive. will understand in the future.

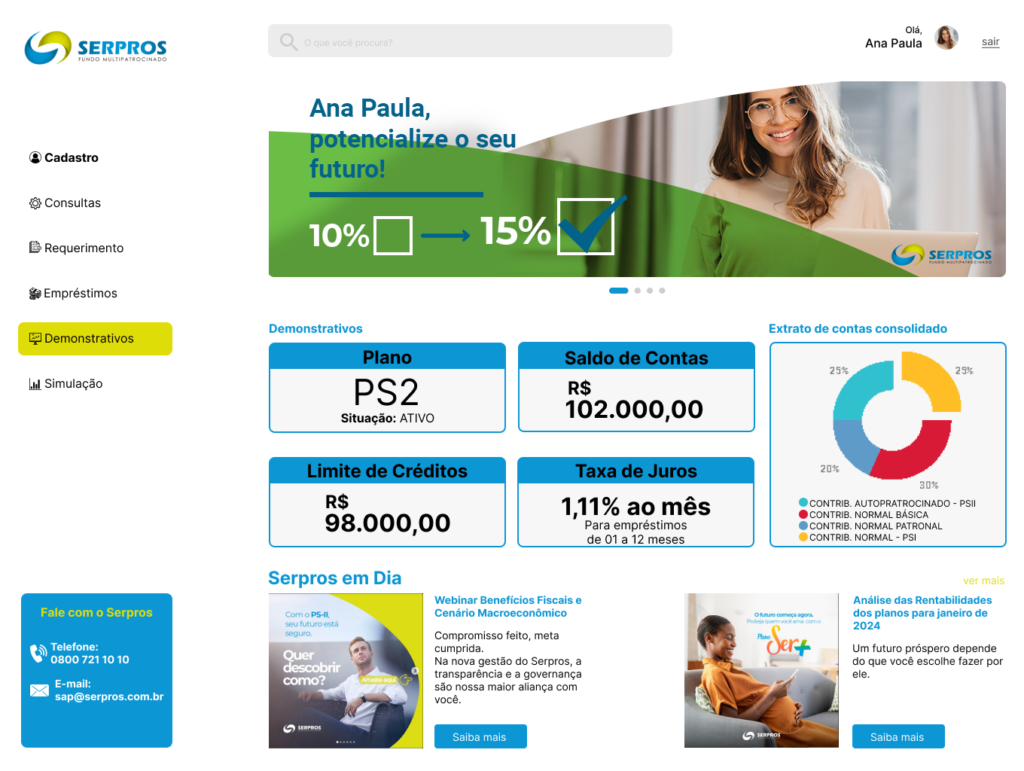

SERPROS provides a detailed simulator on its portal that allows participants to evaluate the impact of their decision on their future income and, in addition, carries out periodic communications encouraging participants to increase their Variable Contribution.

The strategy adopted by SERPROS has not had the expected effect, as approximately 62% of PSII participants make Variable Contributions below 15%.

Even though such information is available to participants, it is very common for them to not be active in searching for such information.

Solution

Considering the mass of data available through SERPROS, we can become protagonists in the process of bringing information to participants, focused on overcoming objections.

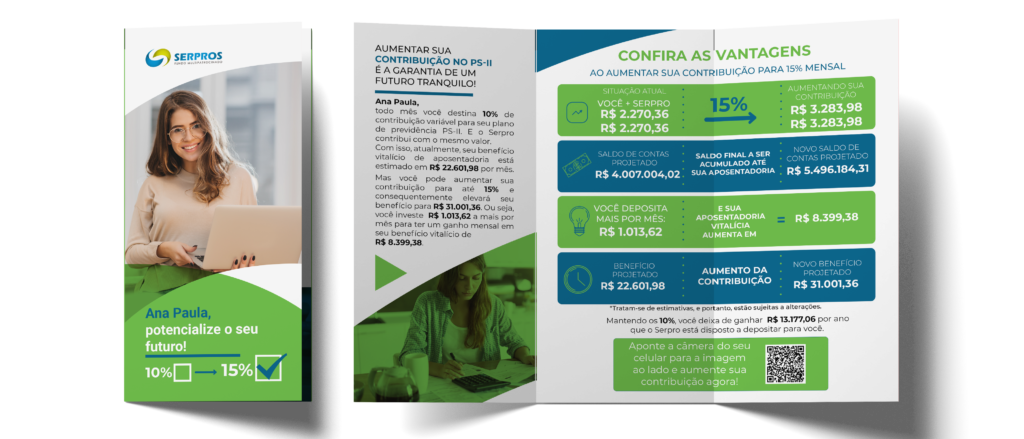

In a personalized way, we will provide each of the participants with 05 arguments to increase their contributions, considering the real data of each of them.

Digital Solution

Marketing Campaing

Learnings

This is a campaign that has to be carried out annually, because it is necessary to demonstrate in an up-to-date way to clients the tax and future benefits in their retirement.

Considering that sensitized participants will continue with their 15% contribution over the next 10 years, the Pension plan will have an increase of R$202 million in contributions.